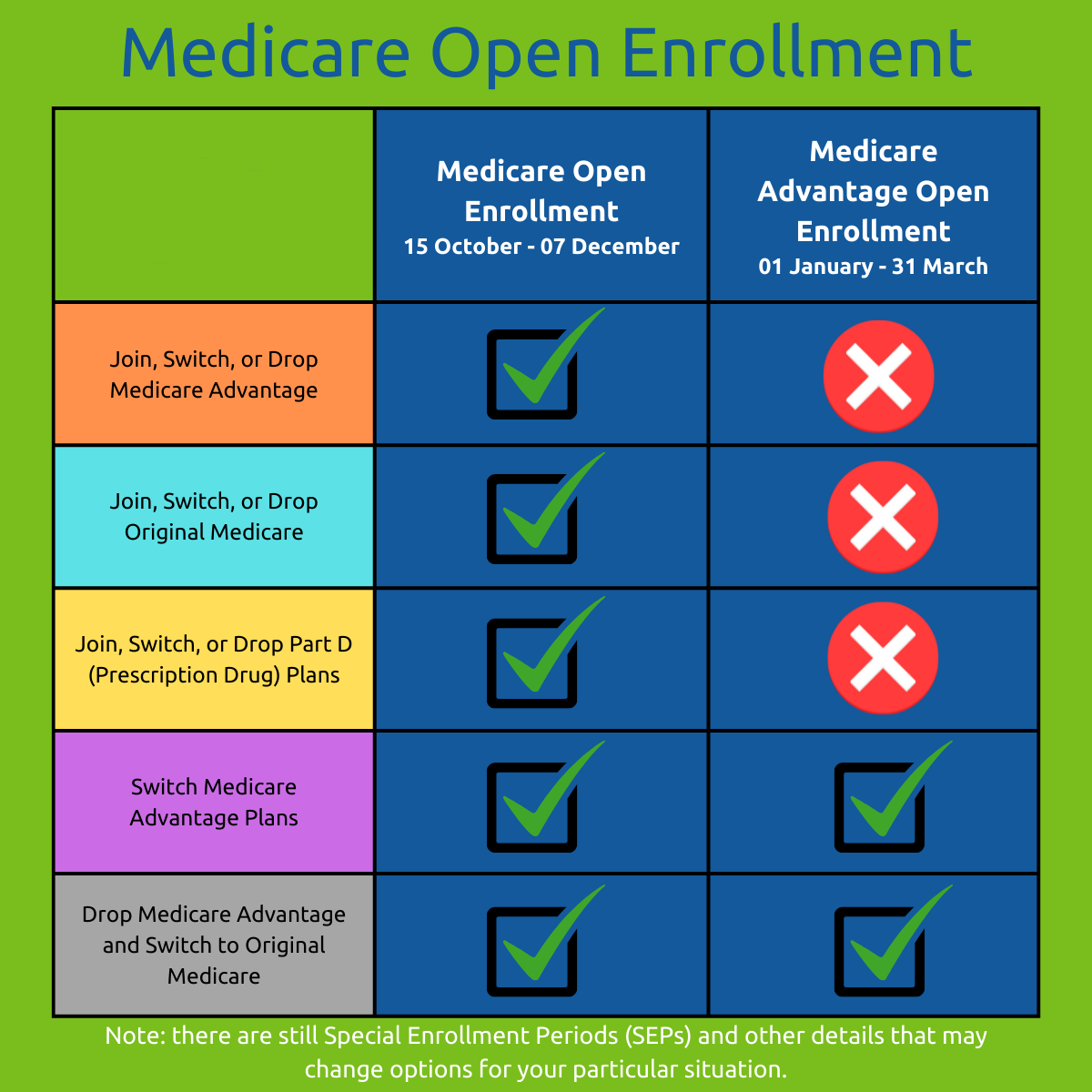

October marks the beginning of open enrollment for Medicare-eligible residents. Medicare open enrollment runs from October 15th to December 7th, while Medicare Advantage open enrolment runs from January 1st to March 31st. Last year, about 30.8 million people enrolled in a Medicare Advantage plan, accounting for more than 51% of the Medicare-eligible population. So, which should you choose: Traditional Medicare or Medicare Advantage plan (Part C)? This is a very important decision. Switching between traditional Medicare and an Advantage plan is difficult until the next open enrollment. Please stay informed, do your research, and don’t fall for sales pitches.

Medicare is a federally funded program. Under traditional Medicare, providers are directly paid by Medicare. Medicare Advantage plans are federally funded but administered through private insurance companies. These companies market aggressively to persuade seniors to choose their plans or switch from traditional Medicare.

Medicare Advantage plans are a “one-stop shop” for all. You don’t need prescription drug coverage or a supplemental insurance plan. They appear to be cheaper since they charge low monthly premiums and cap out-of-pocket expenses. However, there are a lot of downsides. First, they limit your choices. These plans limit physicians, providers, and facilities within their network. Not only that, but they also require referrals to see a specialist. The other big downside is that they require preapproval for expensive procedures, medications, and rehab stays. The third downside is that they limit your care. Your doctor or facility may say you need more care, but these plans will say no or set limits like 2 days or 5 days and end your coverage. Then you need to forgo coverage or pay privately, which is very expensive. From my experience, Medicare Advantage plans are great when you are healthy and don’t require a lot of healthcare services. But when you do require expensive procedures, hospitalizations, and rehab, they tend to deny those services.

Traditional Medicare is better when you need healthcare services. You may have to sign up for Part B, prescription drug coverage, and supplemental coverage separately. Also, traditional Medicare Part B covers 80% of the cost, and you are required to pay 20% as co-insurance. This may make traditional Medicare seem expensive. But under traditional Medicare, you can see any doctor or go to any hospital or facility that accepts Medicare. Most doctors and hospitals do accept Medicare. There are no networks, unlike Advantage plans. Most importantly, traditional Medicare beneficiaries avoid the delays and frustrations of prior authorization. Also, traditional Medicare usually doesn’t restrict your coverage or rehab stay.”